Criteria & Assessment Process

Preamble

The Corporate Excellence Awards were instituted by MAP in 1982 with the sole aim to recognize and honor companies showing outstanding performance and demonstrating progress and enlightened management practices.

These Awards are divided into Industrial and Financial categories, and Not-For-Profit organizations.

The award in the Industrial category has been named as the Amir S. Chinoy Corporate Excellence Award, to recognize the contributions made by Mr. Amir S. Chinoy towards MAP, being the founding member and the first President of MAP.

The Industrial and Financial category companies which have qualified have been further sub-divided into following sectors/groups based on present classification adopted by Pakistan Stock Exchange:

Industrial Category

| OIL & GAS EXPLORATION COMPANIES | ENGINEERING | CHEMICAL |

| PAPER AND BOARD | AUTOMOBILE ASSEMBLERS | AUTOMOBILE PARTS AND ACCESSORIES |

| CEMENT | FERTILIZER | FOOD & PERSONAL CARE PRODUCTS |

| PHARMACEUTICALS | TRANSPORT | MISCELLANEOUS |

| POWER GENERATION & DISTRIBUTION | TEXTILE COMPOSITE | SUGAR & ALLIED INDUSTRIES |

| OIL & GAS MARKETING COMPANIES |

Financial Category

| MODARABAS | LEASING COMPANIES |

| COMMERCIAL BANKS | INSURANCE |

Not-For Profit Sector

| SHAUKAT KHANUM MEMORIAL HOSPITAL | THE LAYTON RAHMATULLAH BENEVOLENT TRUST | THE CITIZENS FOUNDATION |

Methodology

Phase – 1

Screening Dividend Payment

The primary qualifying criteria of first short-listing companies is payment of at least 45% aggregate dividend (Cash and / or Bonus Shares) over the last three years.

Phase – 2

Detailed Financial Evaluation

– Industrial Category

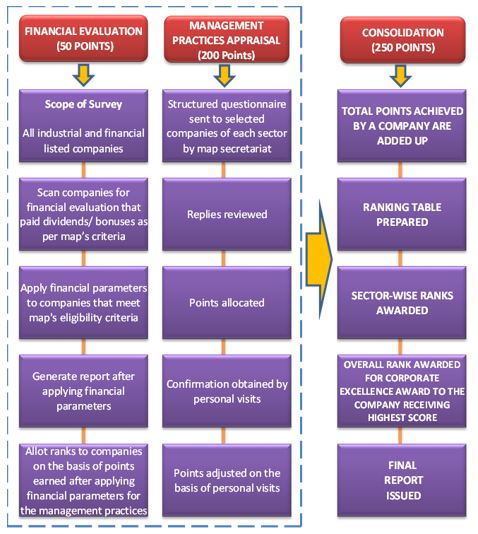

Phase 2 consists of detailed financial evaluation of the companies short-listed on the basis of the primary criteria. This evaluation is done from their annual reports for the last three years by applying following ratios, each having equal points from an aggregate of 50 points.

| 1. | Return on Capital Employed |

| 2. | Asset Turnover Ratio |

| 3. | Earnings Per Share |

| 4. | Acid Test /Quick Ratio |

| 5. | Ratio of Market Value to Book Value of Shares |

– Financial Category

The Financial Category companies’ ratios have been established with the assistance of Pakistan Credit Rating Agency (PACRA) and Pakistan Insurance Corporation. These ratios and the points allotted for them are as follows:

| S.No | Ratio |

Commercial Banks |

Insurance Companies | Financial Services, Modarba & Leasing Companies |

| 1. | Return on Capital Employed | 10 | 10 | 10 |

| 2. | Asset Turn Over Ratio | 10 | 10 | 10 |

| 3. | Ratio of Net Impaired lending to Equity | 10 | – | 10 |

| 4. | Ratio of Liquid Assets to (Deposits + Borrowings) | 10 | – | – |

| 5. | Ratio of Total Finance to (Deposits + Borrowings) | 10 | – | – |

| 6. | Premium Solvency Ratio | – | 10 | – |

| 7. | Ratio of Net Investment Income to Premium Earned | – | 10 | – |

| 8. | Combined Ratio | – | 10 | – |

| 9. | Ratio of Liquid Assets to Total Funding | – | – | 10 |

| 10. | Ratio of Total Debts to Equity | – | – | 10 |

| Total | 50 | 50 | 50 |

Time Weight-age of Ratios

The financial evaluation covers the period of preceding three years in order to absorb the effects of fluctuations and also to recognize the impact of long term policies and strategic decisions. The following weightage is assigned to the results of financial evaluation.

Year n 4

Year n – 1 2

Year n – 2 1

Phase – 3

Management Practices Appraisal

The next step in the assessment process is the appraisal of management practices of the companies qualifying the financial assessment. Top five (5) companies in each PSX sector are required to complete the management appraisal questionnaire.

In order to facilitate marking the questions have been divided into following management areas:

| Corporate Governance | 160 | Customer & Market Focus | 90 | |

| Strategic Planning & Communication | 220 | Human Resource Focus | 250 | |

| Leadership | 60 | Operations Management | 80 | |

| Social Responsibility | 70 | Information/Risk Management | 70 | |

| Total 1000 marks | ||||

Phase – 4

Top Management Meetings

On receipt of the completed questionnaire, a two-member team from our out-sourced partner M/S FAMCO represents MAP for site visit and detailed meetings with top management of each short-listed company. The purpose of these meetings is to verify and obtain a vital, face to face view of the responses to the questionnaire. During these meetings the team not only discusses their management practices but also witnesses the evidence of claims made in the questionnaires as well as policy documents. After the top management meetings the questionnaires are marked.

Phase – 5

Final Tabulation of Results

The marks obtained by the companies for Management Practices Appraisal on the basis of 1000 marks are recalculated on the basis of 200 points. The Final tabulation is thus done on the basis of 50 points for financial evaluation and 200 points for management practices appraisal, thus maintaining the 20:80 weightage for each aspect. The final result is presented to the Corporate Excellence Award sub-committee which forwards the same to the MAP Executive Committee for approval and announcement.

Awards

Under the Awards Scheme, there is one circulatory Trophy for the overall winner in each category namely, Industrial Category and Financial Category. In addition, there are trophies for the top companies in the remaining sectors in both categories and certificates of excellence for not-for-profit organization.